Leasing or Lease Financing is one of the most important and most flexible financial service.

Lease

A Lease is a contractual arrangement or transaction between two or more parties, in which one party owning an asset or equipment (lessor) provides an asset to another party (lessee) for use or transfers the right to use the asset, over a certain or agreed period of time for consideration in form of periodic payment (rentals) with or without charging a premium. At the end of the period (lease period) the asset or equip reverts back to the lessor.

Lease Financing

Lease Financing or Leasing is a process where one party (lessor) transfers the right of economic use of an asset to another party (lessee).

Lease Financing essentially involves the divorce of ownership from the economic use of the asset for the lessor i.e. The Lessor is the owner of the capital asset and the ownership of the asset always remains with him, but the right to use the asset is transferred to the lessee. Lessee is the party who takes the asset or equipment for a specified period and has to pay lease rentals throughout the lease period.

Leasing or Lease Financing is generally used to finance fixed asset having high value.

Advantages of Lease Financing

- It helps is reducing the financial burden on lessee.

- It is a device of financing the cost of an asset.

- It is an important financial service as it provides benefit to both parties.

Elements in Lease Financing

(i) Parties to contract –

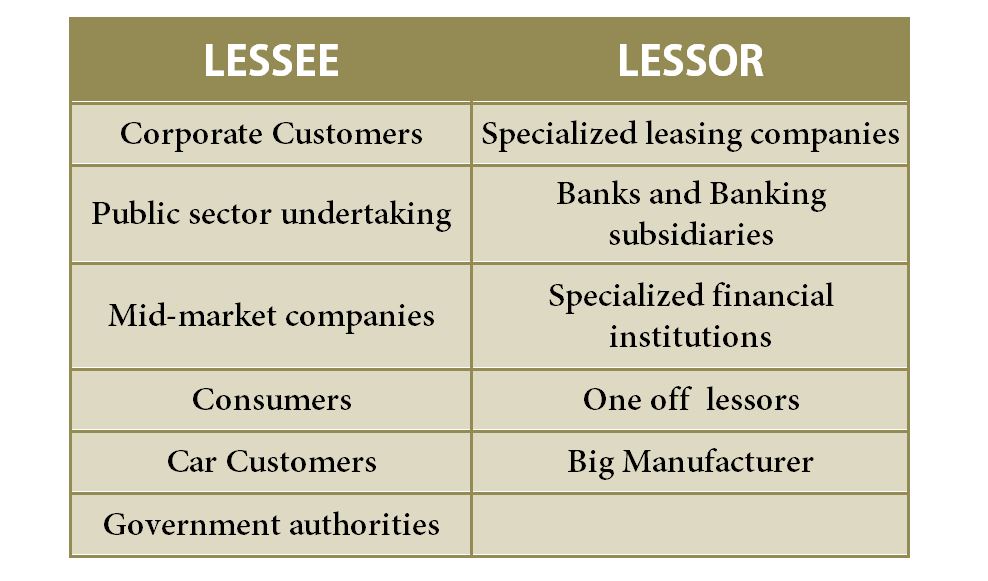

- Owner and user or lessor and lessee – They may be individuals, partners, joint stock companies, corporation or financial institutions

- Joint lessor or lessee

- Lease broker – merchant banker, subsidiaries, private merchant

- Lease financier

Parties involved in Lease Financing –

(ii) Asset – The asset, property, equipment is the subject matter of the contract. It may be an automobile, plant and machinery, equipment, land and building, factory, business, aircraft etc. Ownership of asset is separated from use of asset during the lease period.

(iii) Term Period – The time period for which the asset is taken on lease is called lease period. Every lease has a specified or definite period after which it expires. On the basis on contact between the lessor and lessee the lease period may be of two types:

- Primary lease period – Time in which investor wants the interest on investment

- Secondary ease period – Time for charging nominal rental

(iv) Consideration – Lease Financing involves consideration in form of lease rentals to be paid by the lessee to the lessor for a specified term period. The amount of lease rental is decided by taking into account –

- the cost of investment

- cost of repair and maintenance

- depreciation

- taxes

- and adjusted value of cash flows (time value of money).

Modes of terminating Lease

At the end of the lease period, There can be four possible outcomes of lease expiration:

- The lease is renewed on a perpetual basis or extended for a definite period

- The asset reverts back to the lessor

- The lessor sells the asset to a third party

- Lessor sells asset to the lessee

Parties may mutually agree to any one of the following alternatives at the beginning of the lease term.

Next: Types of Lease

Please conform about lease finance once again . as of my point of view if the leased asset is purchased out of borrowed funds (finance) then it may called lease finance , lessor get benifited for interest on loan and immediate cash outflows could be avoided ,

If the leased asset is purchased through borrowed funds it is called a leverage lease. In such a lease the asset is financed partly by the lessor and partly by a financial institution. Generally assets with require very huge amount of capital as financed through this lease. Eg. Big Real Estate projects

The lessor may or may not charge a higher interest rate from lessee than what he is charged by the lender (bank).

The lessor usually provided 20%-40% cost of the asset therefore immediate cash outflow cannot be avoided but it helps reducing the financial burden.

Feel free to ask more questions. I hope your satisfied with the answer.