National income is the sum total of money value of all the final goods and services produced within the domestic territory of a country in an accounting year plus the net factor in come from abroad.

National Income = Value of Goods + Value of Service + Net Factor Income from Abroad

What is National Income?

- It is the sum total of the value of all the final goods and services produced in an economy during one year.

- All goods and services and measured in terms of money.

- It includes net factor income from abroad.

Factor Income/Payment – Factor payments are rewards received by the owners of factors of production like land, labour, capital and entrepreneurship from industries abroad. They may be in form of:

- Employee compensation

- Profit

- Interest

- Rent

The people residing in India also give factor payments for using factors of production owned by people abroad like payment for importing goods, use of foreign technology etc.

Net Factor Income from Abroad (NFIA) – It is the difference between Factor Income received from abroad by residents of a country and the factor payments made by the residents of a country for factor services rendered by non-residents.

Basic Concepts of National Income

(1) Gross Domestic Process (GDP) – It refers to the money value of all the goods and services that are produced within the domestic territory of a country during a certain period usually a year.

The goods and services in question may be consumer goods and services or capital goods and services, they may be durable or non-durable products, they may be produced by private sector or public sector but it does not include value of intermediate goods and services.

(2) Net Domestic Product (NDP) – When depreciation on fixed capital used in production of goods and services is deducted from the GDP (gross domestic product) of a country we get Net Domestic Product

NDP = GDP – Depreciation

GDP = NDP + Depreciation

(3) Gross National Product (GNP) – When we add the net factor income from abroad (NFIA) to the GDP of a country we get Gross national Product.

GNP = GDP + NFIA

GDP = GNP – NFIA

(4) Net National Product (NNP) – It refers to the total value of all the final goods and services produced in an economy during a certain period after deduction of depreciation.

NNP = GNP – Depreciation

(5) Net Domestic Product (NDP) – It we deduct the net factor income from abroad from the net national product we get Net Domestic Product.

NDP = NNP – NFIA

NNP = NDP + NFIA

(6) NDP at Factor Cost and NDP at Market Price

Net Domestic Product @ Factor cost – It refers to the total value of earnings received by all the factors of production within the domestic territory of a country during a year. NDP @ FC includes cost of Compensation of Employees + Operating Surplus + Mixed Income

Net Domestic Product @ Market Price – It refers to the market value of all the final goods and services produced within the domestic territory of a country during a year.

For a stable economy the NDP @ FC and NDP @ MP must be equal.

NDPfc = NDPmp – Indirect taxes + Subsidies

NDPmp = NDPfc + Indirect taxes – Subsidies

(7) Personal Income – It is the income actually received by the individuals or households in a country during one accounting year, but undistributed profits of enterprise and Taxes are deducted from private income as they are not distributed.

Personal Income = Private Income – Undistributed profits – Corporate Profits – Retained earnings of foreign companies – Taxes

(8) Private Income

Private Income = National Income – Income from Property, Entrepreneurship, commercial and administrative enterprises – savings of non-departmental enterprise of the government

+ Interest on National Debt + Net current transfers from Government + Current Transfers from Abroad

(9) Personal Disposable Income (PDI) – Portion of Income from Personal Income that is available for individuals for actual consumption.

PDI = Personal Income – Personal Taxes – Direct Taxes – Fines, fees, receipts of Govt.

(10) Other:

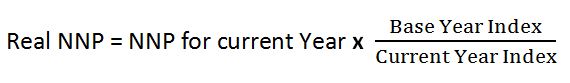

Real Income – National Income expressed in terms of general level of prices.

Operating Surplus = Rent + Interest + Profit + Dividend and Other similar income

Mixed Income = Labour Income + Property Income

Net Indirect Taxes = Indirect taxes + Subsidies

National Income Aggregates

National Income – NNPfc or NIfc = NImp – Indirect taxes + subsidies

Or NIfc = NImp – Net Indirect Taxes

GDPmp = GNPmp – NFIA

GNPmp = GDPmp = NFIA

GDPfc = GDPmp – Net Indirect Taxes

GNPfc – GNPmp – Net Indirect Taxes

NDPmp = GDPmp – Depreciation

NIfc or NNPmp = GNPmp – Depreciation

NDPfc = GDPfc – Depreciation

NIfc or NNPfc = GNPfc – Depreciation

Gross National Disposable Income (GNDI) = GNPmp + Net Current transfers from rest of the world

Net National Disposable Income (NNDI) = NNPmp + Net Current Transfers from rest of the world

- To get from GDP to NDP deduct (-) Depreciation)

- To get from NDPmp to NDPfc deduct (-) net indirect taxes

- To get from GDPmp to GNPmp deduct (-) Net Factor Income from Abroad

Methods of Measuring National Income

(1) Product/Output/Value Added Method –

National Income = GDPmp – Depreciation + NFIA – Indirect Taxes + Govt. Subsidies

(2) Income Method –

National Income = Wage + Rent +Interest + Dividend + Undistributed Profit (Operating Surplus)

+ Opening Stock of Public Enterprise

+ Mixed Income from Self Employed

+ Direct taxes collected by government

+ Net Factor Income From Abroad (NFIA)

+ Value of Production for self-consumption

(3) Expenditure Method –

National Income = Private Consumption + Private Investment + Government Consumption + Changes in Stock + Net Exports of Goods and Services

Net Exports of Goods and Services = Exports – Imports

Compare to notes given by my teacher this is good and precise 😀😀 bt the thing is I am not understanding formulas !!😬😬😓😓😓😭😭😔😖📚�😭

Oh then study