Credit control is an important tool of the monetary policy used by Reserve Bank of India (central bank) to control the demand and supply of money and flow of credit in an economy. RBI keeps control over the credit created by commercial banks.

Objectives of Credit Control

The primary objective according to RBI is ‘to control inflationary tendencies present in the economy to ensure high economic growth with adequate level of liquidity and maximum utilization of resources’

- To achieve internal price stability

- To achieve financial Stability i.e. stability in money market

- To achieve stability in foreign exchange rate

- To meet the financial requirement during slump in the economy

- To maximize income, output and employment in the economy

- To eliminate business cycles and meet business needs

- To promote economic growth and development of the country

Credit Control by RBI

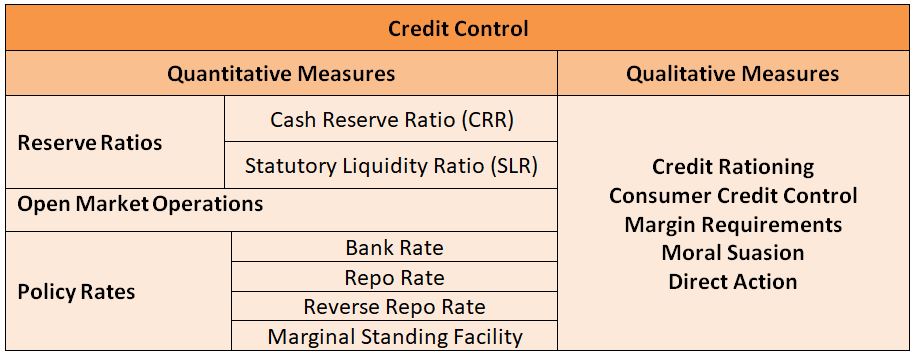

Quantitative Measures of Credit Control

These tools control the cost and quantity (volume) of credit.

(1) Reserve Ratios

• Cash Reserve Ratio – Banks have to keep a certain minimum percentage of their total deposits (demand deposits + time deposits) with the RBI, that minimum percentage is called CRR. A change in CRR affects the credit creation capacity of the commercial banks.

An increase in CRR results in less liquid cash deposits with the commercial banks and a fall in the value of deposit multiplier which reduces the volume of credit in the economy and a decrease in CRR results in more liquid cash available with the banks and rise in the value of deposit multiplier which increases the volume of credit.

• Statutory Liquidity Ratio – All banks are required to maintain a minimum percentage of their total deposits as liquid assets in form of cash, gold or securities with themselves known as SLR.

A change in SLR has the same effect on volume of credit as in the case of change in CRR.

(2) Open Market Operations

Buying and selling of government securities by the RBI in the open market is called open market operations.

When RBI buys government securities the volume of credit increases and when securities are sold the volume of credit decreases. When commercial banks make payment to the RBI for securities bought, their cash reserves reduce which leads to a reduction in their ability to create credit. This makes advancing loans to consumers difficult for commercial banks as they have limited funds. This leads to contraction of credit in the economy.

(3) Policy Rates

• Bank Rate Policy – It is the policy under which RBI influences the volume of credit in the economy by manipulating the bank rate.

Bank rate is the rate at which RBI lends money to the commercial banks. It the interest rate charged by the RBI when advancing loans to commercial banks against bills of exchange, commercial papers etc. An increase in bank rate is likely to increase all other market rates, which leads to contraction of credit while a decrease in bank rate leads to expansion of credit.

When RBI increases the bank rate, the commercial banks are discouraged from taking loans as now they have to pay a higher interest rate on loans from central bank then before. The commercial banks in turn start charging higher interest rate from consumers (traders and businesses) seeking loans which increases the cost of credit. The high cost of credit discourages consumers to take loans. This reduces the volume of credit in the economy. The opposite happens when the bank rate is decreased.

• Liquidity Adjustment Facility – Under this facility, RBI provides liquidity to scheduled commercial banks and primary dealers or absorbs excess liquidity on an overnight basis against approved government securities.

The interest rate at which RBI provides liquidity to banks under Liquidity Adjustment Facility is known as Repo rate.The interest rate at which RBI absorbs excess liquidity of banks is known as Reverse Repo Rate.

An increase in repo rate increases the cost of credit for commercial banks and leads to a reduction in amount of credit created in the economy. The increase in reverse repo rate has the opposite effect on credit creation.

• Marginal Standing Facility – Under this facility the commercial banks can borrow additional money from the RBI on overnight basis up to a certain limit of their Statutory Liquidity Reserve (SLR) (currently 2% of net time and demand deposits)at an penal interest rate(currently 0.25% above repo rate).

An increase in MSF has the same effect on credit as in case of increase in Bank Rate or Repo rate.

| Current Reserve and Policy Rates in India | % |

| Cash Reserve Ratio (CRR) | 4% of NDTL* |

| Statutory Liquidity Ratio (SLR) | 20.5% of NDTL |

| Bank Rate | 6.50% |

| Repo Rate | 6.25% |

| Reverse Repo Rate | 6% |

| Marginal Standing Facility (MSF) | 6.50% |

Current Interest Rates in India as of May, 2017

Qualitative Measures of Credit Control

These tools control the use and direction (flow) of credit.

(1) Credit Rationing – Credit rationing is controlling the amount of credit available for certain industrial sectors in order to ensure that all sectors get adequate amount of credit. Under this method RBI fixes ceiling (maximum limit) on loans and advances for specific categories, which the commercial banks cannot exceed.

(2) Moral Suasion – Moral suasion is the method by which RBI persuades and convinces the commercial banks to undertake certain actions which are in the economic interests of the country. Under this method the RBI requests and persuades the commercial banks to work in cooperation with the central bank in implementing its credit and monetary policies.

(3) Changing Margin Requirements – Under this method the RBI prescribes margin requirements that commercial banks have to maintain on securities against which loans are provided to customers. RBI sets different margin requirements for different types of securities. A change in margin requirements influences the flow or direction of credit. An increase in margin requirements; decreases the flow of credit while a decrease leads to an increase in flow of credit.

(4) Regulating Consumer Credit – Consumer credit refers to loans taken by people for purchase of goods and services. RBI regulates the total volume of credit that may be extended to customers by the commercial banks and fixes a minimum time period for repayment or increases down payment required for specific categories to influence the flow of credit in a particular direction.

(5) Direct Action – When all the methods mentioned above prove ineffective in controlling credit, RBI takes a direct action by laying down specific rules and regulations under which the commercial banks will operate. A strict action is taken against banks that refuse to follow the directions of the RBI.

Importance of Credit Control

- It helps in achieving the primary objective of controlling inflation through price stability (stable price level of goods and services) and financial stability (equalizing demand for money with supply of money).

- It helps in boosting the economy by facilitating adequate flow and volume of bank credit to different sectors and encourages growth of priority sectors by providing adequate credit to priority sectors essential for economic development

- Encourages judicious delivery of credit by keeping check on credit granted for undesirable purposes by commercial banks

* NDTL – Net Time and Demand Deposits

why can’t we copy it? 🙁

Thanku.. So much it helped me.. Alot to clear my concept about credit control.