Risk – It refers to the degree or probability of loss in the future.

Causes of Risk

- Wrong decision or Wrong timing

- Term of Investment – Long term investments are more risky than short-term investments as future is uncertain.

- Level of Investment – Higher the quantum of investment the higher is the risk.

- Nature of Industry – Risk is higher in speculative and cyclical industries while less in defensive and growth industries.

- Political and Legal factors – Risk may arise due to changes in government policy and legislative regulations in a country.

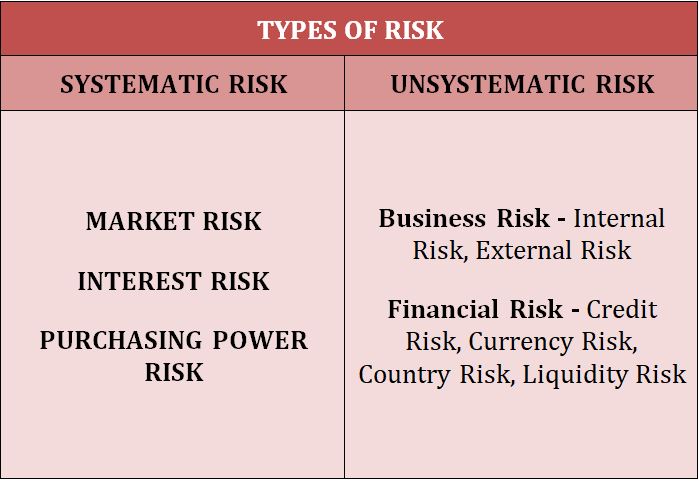

Types of Risk

Systematic Risk

It refers to the risk caused by factors external to a business which affects the entire industry and not any specific business. They are uncontrollable and unavoidable by a business and are associated with economic, social, legal and political aspects of all securities in an economy.

- Market Risk – It is the risk caused by the alternating forces of demand and supply (bear and bull market) i.e. the value of investment increases or decreases due to the movements in the market factors. These factors may be tangible or intangible. In Bull Market, when the economy is booming the Security Index takes an upward swing and increases for a significant period of time while the opposite happens in a Bear Market.

- Interest Risk – It is the risk that adversely affects the investment due to unexpected changes in market interest rates. A change in monetary policy by the central bank will directly affect the debt instruments like bonds and debentures due to changes in interest rates.

- Purchasing Power Risk – It refers to the risk of reduction in purchasing power of expected returns due to high rate of inflation.

Unsystematic Risk

It refers to risk caused by the factors internal to a business and unlike systematic risk it is specific to a business and hence can be controlled by the business. It arises due to lack of operating efficiency in a business or due to its inability to grow or maintain competitive edge or achieve stable profits.

- Business Risk – It arises due to: Internal risk – It is associated with the operational efficiency of the business, and External risk – It is associated with the economic, social, political and legal factors external to the business which can affect it adversely.

- Financial Risk – It is the risk related to the capital structure of a business. An inefficient capital structure results in financial instability and leads to unstable earnings. Hence there must be an optimum mix of debt and equity to ensure financial stability and reduce financial risk. Types of Financial Risk – Credit risk, Currency risk, Country risk, Liquidity risk